At EnergyX, we believe in the transformative power of clean energy. The world is at a pivotal moment, and the investment landscape is shifting dramatically. Investors are increasingly focusing on renewable sources, and the returns on these investments are speaking volumes. As we collectively address the pressing challenges of climate change and the need for sustainable energy solutions, the performance of clean energy stocks has surged, outpacing traditional fossil fuels. This shift isn’t just a trend—it’s a revolution, and we’re proud to be at the forefront.

Sustainable Energy Stock Performance: A Comparative Analysis

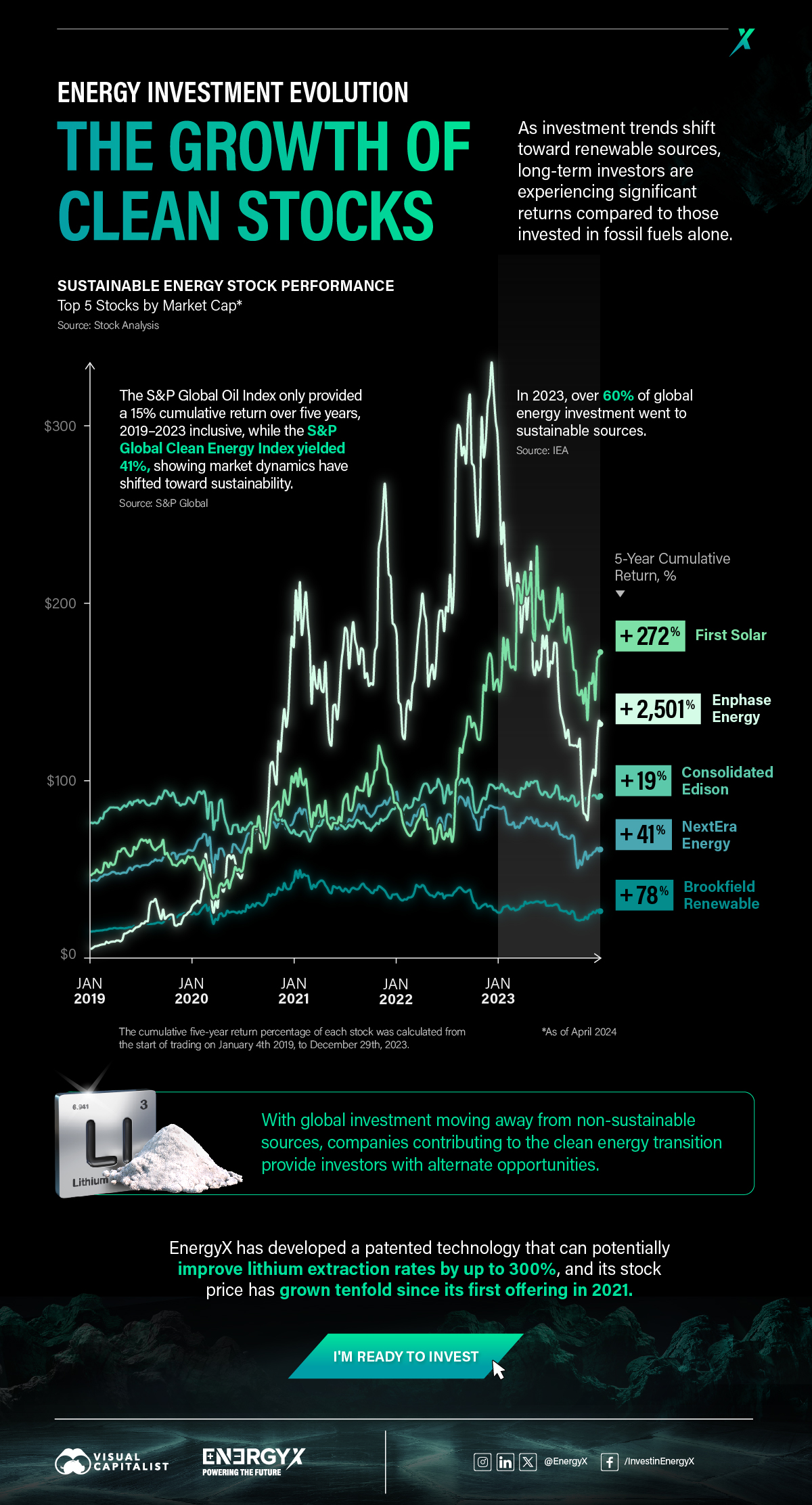

Recent data highlights the impressive performance of sustainable energy stocks. The S&P Global Oil Index offered a modest 15% cumulative return over five years from 2019 to 2023. In contrast, the S&P Global Clean Energy Index yielded a remarkable 41%, showcasing the robust shift in market dynamics toward sustainability.

The top five public stocks by market cap in the clean energy sector have shown impressive cumulative returns over the past five years:

First Solar: +272%

Enphase Energy: +2,501%

Consolidated Edison: +19%

NextEra Energy: +41%

Brookfield Renewable: +78%

These figures demonstrate growing investor confidence in sustainable energy companies, which are not only performing well but also offering substantial returns on investment.

The Shift Towards Sustainability

In 2023, over 60% of global energy investments were directed towards sustainable sources. This significant allocation underscores the growing recognition of the importance of transitioning to cleaner energy. As the world moves away from non-sustainable sources, companies like ours are providing investors with alternative opportunities for growth and profit.

EnergyX: Leading the Charge in Direct Lithium Extraction

At EnergyX, we’re proud of our role in the clean energy transition. We have developed patented technologies that improve lithium extraction rates by up to 300% compared to traditional methods. Our private stock price has grown tenfold since our first crowdfunding offering in 2021. As lithium plays a crucial role in the production of batteries for electric vehicles and renewable energy storage, our advancements are set to have a significant impact on the clean energy sector.

Why Invest in Clean Energy Stocks?

With the global investment community increasingly moving away from fossil fuels, clean energy stocks present a compelling investment opportunity. The strong performance of these stocks, coupled with the growing emphasis on sustainability, makes them an attractive option for long-term investors.